8 Oct, 2018

Farewell September and Trade Plan 10/1/2018We had 4 weeks of trading in September but we didn’t place a trade the first week because our trade didn’t come to us and I didn’t want to force it. I netted about $1362 gains in my Fidelity account for the month. This was a successful month! Market futures for Monday are very green as I type. This is probably due to some positive trade news with Canada. The major markets and the VIX are all near the 50s …Read the full article

8 Sep, 2018

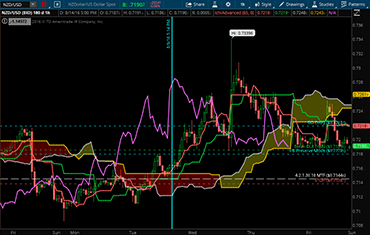

Trade Plan for week of 9/10/2018The market was not strong last week and the major indexes seem to be sitting very close to support levels at the 20 moving average on the daily chart (see SPX, DIA, IWM, VIX), which also happens to be a previous sticky point for many of the indexes (except QQQ, but tech had a rough week last week). Market futures are up slightly as I type. It will be interesting to see how everything fares this week. If the markets …Read the full article

8 Aug, 2018

Trade Plan for week of 9/3/2018Short week this week! The S&P 500 feels “tired” this week but the QQQ looks like it isn’t slowing down. If you look at the chart below, you’ll see that the we are at 70 RSI on the weekly chart and this is typically a spot where we stall. The RSI (Relative Strength Index) is a momentum indicator and RSI > 70 is considered overbought. RSI < 30 is considered oversold. A lower RSI means that the stock isn’t overextended. …Read the full article