26 Nov, 2018

Trade of the Week 11/26/2018

Welcome to our new Digs! We’ve been working over the past few months to upgrade the website and member’s area. Please bear with us as we get moved in!

I hope all of you had a great Thanksgiving and a wonderful time with friends and/or family.

As I reflect on how we’ve been trading this month, I’ve noticed that we need to be more patient in this market on Monday morning. In a strong market, playing the morning gap-up on Monday works ok because the market often holds that trend but this has not worked out well for us recently. A Monday afternoon hold into Tuesday seems to be where we’ve been more successful. My theory here is that we are looking for mix of predictability and volatility with these trades. Monday morning is a very volatile…maybe too volatile, but not very predictable and we’ve been caught buying in bad spots when the market turns over and we’ve rushed to get in at or before market open.

With that said, Market futures are in and look quite green. This is not a move that we should rush to jump into. At this point, we’ve already missed whatever move happens premarket today so don’t rush to buy anything into a big run-up that could be mostly over. If I’m a betting man, I think we get a green market this week because the technicals seem to be pointing to a short rally but there are lots of other factors that could influence this. Fed meeting minutes will be out this week and China/US trade talks are pending at the G20. News always trumps technicals so I’m still skeptical.

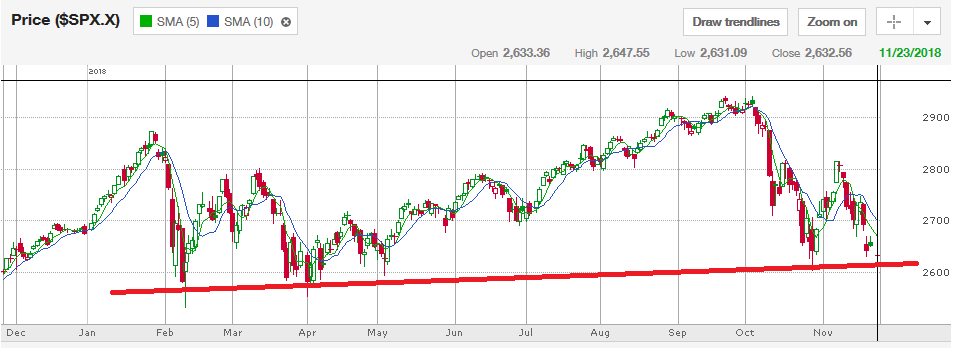

Technically, the market is nearing resistance. If we maintain a bounce off of this, then this could be a playable rally but if it’s whimpy, then that could be bad news.

I’ve got a couple different ideas for this week. If the market falls below this level (see the red line above), then I’m a bear for the week and will probably look to a leveraged ETF like VXX. If the market (and particularly the QQQ) looks good, then I’ll be looking to buy IONS at a good price:

As I’ve noted on this chart, this will need a strong break, and probably a close, above $55 for it to really look good at these levels but this has been going up as the Nasdaq has dropped. If the market is strong, I think this trend will continue.

I think Biotechs look like one of the stronger sectors right now. Oil and energy haven’t really shown much strength and this is a very volatile time for retail.

I’ll post an update if I make any moves!

Leave a Reply