13 Aug, 2018

Trade Plan for Week of 8/13/2018

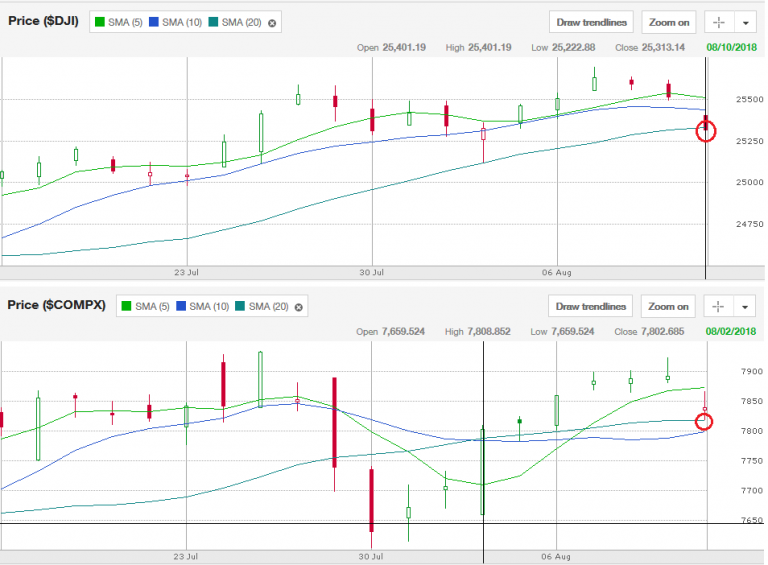

The overall market looks like it will be continuing the pull back that began towards the end of last week. The QQQ, SPX, and DJI daily charts have all pulled back to the 20 SMA:

It isn’t a good idea to force a trade during a weak market and while I think this pullback is short term, I will not trade until I feel like the market has conviction. Don’t try to catch a falling knife!

I will reassess near the close on Monday. I’ve got my eye on Chesapeake Energy Corp (CHK) or maybe another energy/oil play if the energy ETFs hold up. (Energy ETFs: XLE or UNG)

Happy Trading!

Leave a Reply